Capital gains are a tax levied on the sale of an asset. The most common form you will encounter them will be in the trading of Stocks and other monetary items (such as Equity Options) along with things like your home (though there is a nice exemption level if it is your primary residence). The difference between what you buy your asset for (basis) and what you sell it for will be the Capital Gain (or Capital Loss).

Capital gains are a tax levied on the sale of an asset. The most common form you will encounter them will be in the trading of Stocks and other monetary items (such as Equity Options) along with things like your home (though there is a nice exemption level if it is your primary residence). The difference between what you buy your asset for (basis) and what you sell it for will be the Capital Gain (or Capital Loss).

Capital Gains comes in two forms, Short Term Capital Gains, and Long Term Capital Gains. The difference between the two is as follows:

- Short Term Capital Gains – Any Profit on a transaction that occurred within 1 year

- Long Term Capital Gains – Any Profit on a transaction that took place over 1 year

Likewise, the Losses are calculated over the same time periods:

- Short Term Capital Loss – Any Loss on a transaction that occurred within 1 year

- Long Term Capital Loss – Any Loss on a transaction that took place over 1 year

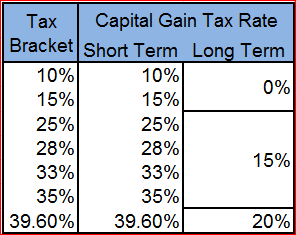

Here are the current rates:

As you can see, the Short Term rates are quite aggressive, and can put a real dent in your hard earned profits. The good news is that if you are making these transactions inside a Tax Advantaged Account you are not subject to these taxes and get to keep all your profit.

Also, you are only subject to paying the tax on your NET Capital Gains. What this means is that your LOSSES cancel out your GAINS. They do this in a like for like manner, so if you have $20K in Short Term Capital Gains and $15K Short Term Capital Loss plus $10K Long Term Capital Loss you will use the $15K first to bring your gains to $20K, then a further $5K of your Long Term to bring it down to zero.

The $3000 Rule

Every year you can carry your Capital Losses forward, and after you have netted out your gains to Zero you can then apply a further $3K against ordinary income- this is a great way to reduce your tax bill and Capital Loss Harvesting is a very powerful portfolio strategy – be wary though, you can incur a Wash Sale if you do it wrong and be in all sorts of extra reporting troubles.

If we apply the $3000 rule to that example above you can use $3K this year to offset regular income, and carry forward the last $2K of your Long Term Capital Loss into the next year.

Leave a Reply